Table of Contents

In a society relentlessly pushing for “more,” the concept of “enough” often feels radical.

“Your Money Or Your Life” challenges this dominant narrative, urging readers to re-evaluate their relationship with money and discover the liberating power of “enough.” The book implores readers to “find enough” and argues that true wealth lies not in endless accumulation but in aligning one’s financial life with personal values and a deep sense of fulfillment.

Escaping the Money Trap: The Illusion of “More”

The authors present a compelling critique of the “money trap,” a pervasive societal belief that equates Finding “Enough” and equates “more” with “better.” This mindset, they argue, keeps individuals perpetually striving, seeking fulfillment in external achievements and material possessions.

The pursuit of “more” often becomes an unfulfilling treadmill, leading to debt, stress, and a sense of emptiness.

- The book highlights the psychological toll of this relentless pursuit. When “more is better,” what we currently have is never enough. This creates a cycle of desire and dissatisfaction, preventing us from finding contentment.

- The authors use the image of a receding horizon to illustrate this point. As we strive for “more,” the goalpost of “enough” keeps moving further away. We get caught in a competitive game, comparing ourselves to others and feeling inadequate.

The Fulfillment Curve: “Enough” as the Pinnacle of Satisfaction

The authors introduce the Fulfillment Curve as a way to visualize the relationship between material possessions and genuine satisfaction. This curve demonstrates that fulfillment does not increase infinitely with increased wealth. Instead, there’s a peak point where we have enough to meet our needs and desires without being burdened by excess.

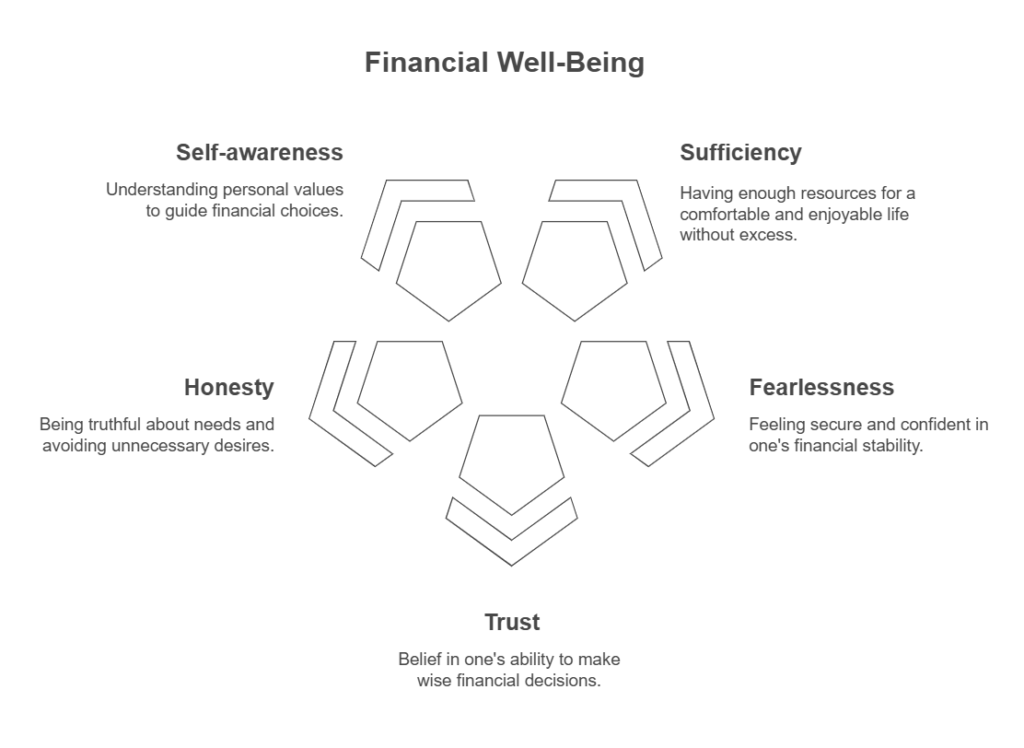

This peak is “enough”. The authors describe it as a state of:

- Sufficiency: Having enough for survival, comfort, and enjoyment without being weighed down by unnecessary possessions.

- Fearlessness: Feeling secure and confident in one’s financial situation, free from anxieties about scarcity.

- Trust: Having faith in one’s ability to provide for oneself and make wise financial decisions.

- Honesty: Being truthful about one’s needs and desires, avoiding the trap of chasing after fleeting wants.

- Self-awareness: Understanding one’s values and priorities, using them to guide financial choices.

The Power of “Enough”: Transforming Your Relationship with Money

The authors of “Your Money or Your Life” propose that embracing “enough” requires a fundamental shift in perspective:

- Shifting from External to Internal Yardsticks: Instead of measuring success based on external factors like social status or the possessions of others, the authors advocate for defining “enough” based on personal values, purpose, and fulfillment. They encourage readers to tune out the noise of consumer culture and focus on what truly brings meaning and satisfaction.

- Cultivating Consciousness in Spending: Mindful spending involves asking key questions about each purchase:

- Did I receive fulfillment, satisfaction, and value in proportion to the life energy spent? This question encourages readers to assess the true return on their spending. It helps differentiate between fleeting pleasure and genuine fulfillment.

- Is this expenditure of life energy in alignment with my values and life purpose? This question prompts reflection on whether spending choices reflect personal values and contribute to a larger sense of purpose. Living in financial integrity, or aligning spending with values, is presented as crucial for achieving “enough.”

- Redefining Work: The authors challenge the conventional definition of work as solely a means to earn money. They suggest separating the concept of work from wages, recognizing that work can also be a source of fulfillment, purpose, and personal growth. This redefinition opens up possibilities for finding greater meaning in both paid and unpaid work. It encourages readers to explore activities aligned with their passions, contribute to their communities, and find satisfaction in their leisure time.

- Embracing Frugality: The authors advocate for creative frugality, which involves using resources wisely to maximize happiness and minimize waste. Frugality is not about deprivation; it is about finding joy in simplicity and making conscious choices about how we use our resources. It’s about living “the American Dream on a shoestring.” The authors encourage readers to view frugality as a path to liberation, freeing them from the pressures of consumerism and allowing them to pursue what truly matters.

The Ripple Effect of “Enough”: Creating a More Sustainable World

“Your Money Or Your Life” suggests that widespread adoption of the “enough” principle could have a profound impact on society and the environment.

- When individuals prioritize fulfillment over accumulation, the demand for excessive consumption naturally decreases. This shift in values could contribute to a more equitable distribution of resources and help address the growing challenges of sustainability.

- The authors envision a world where people are content with “enough” and focus their energies on contributing to the well-being of themselves, their communities, and the planet.

“Enough”: A Journey of Self-Discovery and Financial Liberation

The authors emphasize that the journey to “enough” is a process of self-discovery. It involves:

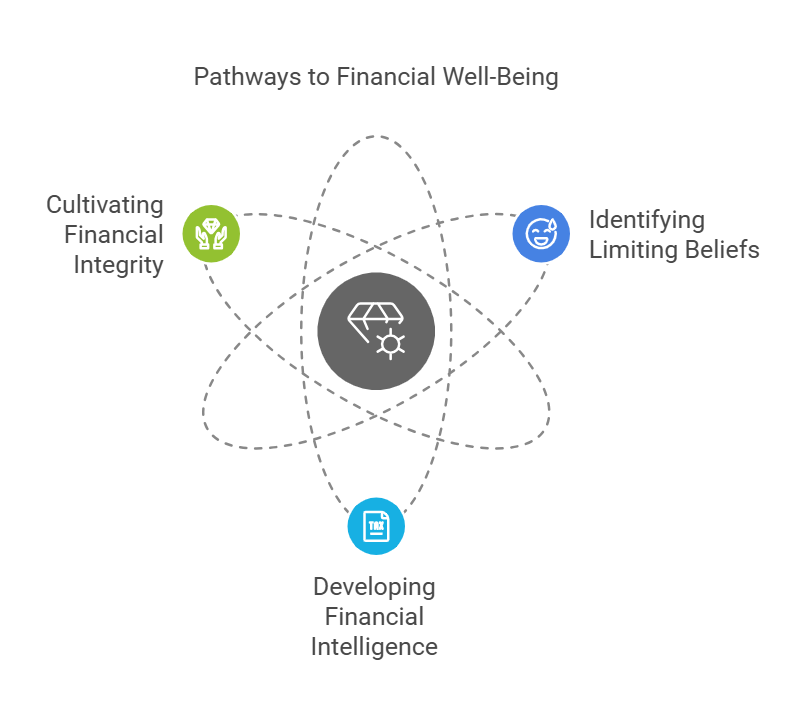

- Identifying and Challenging Limiting Beliefs: The authors encourage readers to examine their assumptions about money and success, shedding outdated beliefs that hinder their financial and personal well-being.

- Developing Financial Intelligence: The book provides practical tools and strategies for tracking spending, analyzing financial habits, and making informed decisions about money.

- Cultivating Financial Integrity: Living in alignment with one’s values is presented as a cornerstone of financial well-being.

Ultimately, the authors believe that discovering “enough” is a journey toward financial liberation and a more fulfilling life. They encourage readers to reclaim their life energy, use it wisely, and invest it in what truly matters.

This journey, they argue, leads to greater peace of mind, increased freedom, and a deeper sense of purpose.

Click to read the full book summary of “Your Money or Your Life“? You can also buy the book on Amazon here

Leave a Reply