Table of Contents

In this Money Master the Game summary, we take a deep look at the book, “MONEY Master the Game” which is a comprehensive guide to achieving financial freedom, drawing on the wisdom of some of the world’s most successful investors.

Author Tony Robbins distills their insights into actionable steps that anyone can follow, regardless of their current financial situation.

“A part of all I earn is mine to keep…Say it in the morning when you first arise. Say it at noon. Say it at night. Say it each hour of every day. Say it to yourself until the words stand out like letters of fire across the sky.”

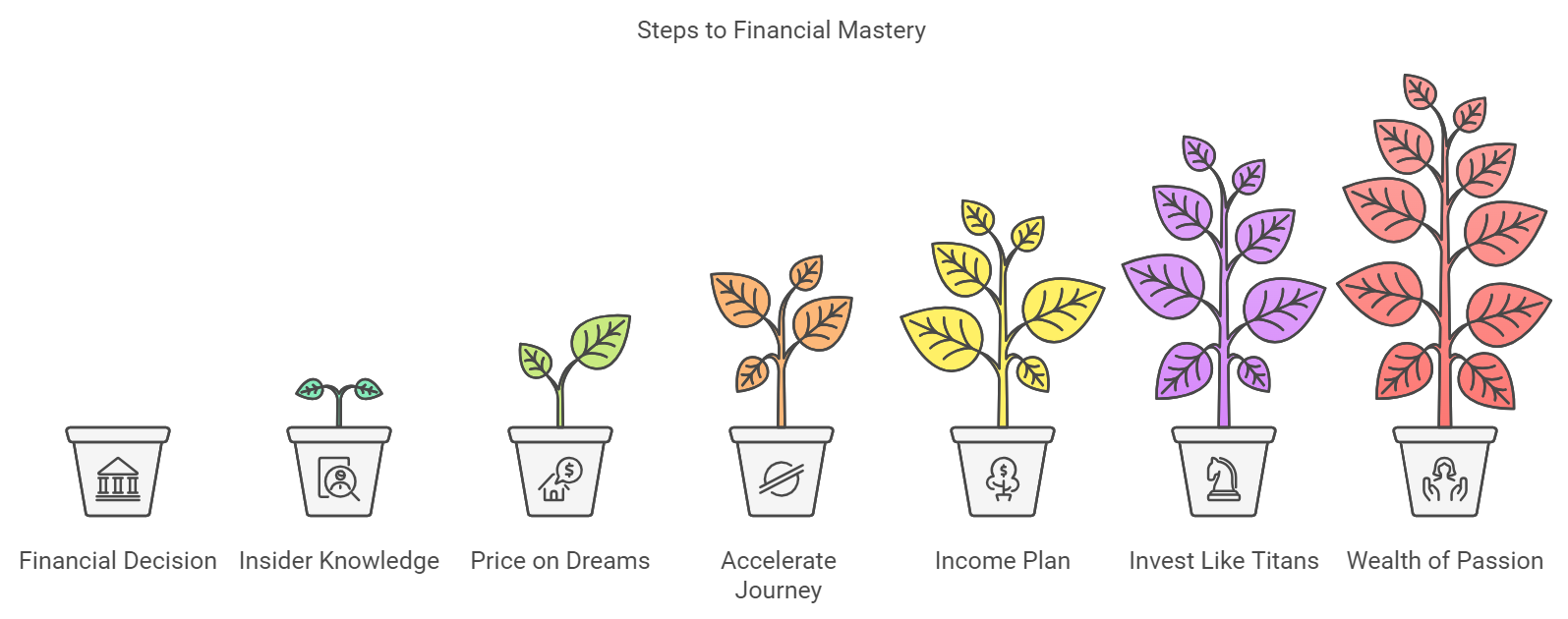

The 7 Simple Steps to Financial Freedom

The core of the book is a seven-step plan for achieving financial freedom, which includes:

- Making the Most Important Financial Decision of Your Life: This involves deciding what percentage of your income you will save and invest. The book emphasizes the importance of automating this process, creating a “money machine” that consistently builds wealth.

- Becoming an Insider: This step is about understanding the rules of the financial game and avoiding common pitfalls, such as high fees and deceptive marketing tactics. The book debunks common myths, like the belief that actively managed mutual funds outperform the market.

- Putting a Price on Your Dreams: This involves determining how much income you need to achieve your financial goals, whether it’s financial security, independence, or complete freedom.

- Accelerating Your Journey: This step focuses on strategies to increase savings, boost income, and minimize fees and taxes, all of which contribute to faster wealth accumulation.

- Creating a Lifetime Income Plan: This involves building a portfolio that generates a steady income stream, regardless of market fluctuations. This step addresses concerns about outliving savings and provides strategies for protecting against market downturns.

- Investing Like the 0.001%: This step involves learning from the investment strategies of billionaires and financial titans. The book features interviews with renowned investors, such as Ray Dalio, Warren Buffett, and Carl Icahn, providing insight into their asset allocation and investment principles.

- The Wealth of Passion: This final step emphasizes the importance of finding meaning and purpose in life, not just financial success. The book encourages readers to live with passion and use their wealth to make a positive impact on the world.

“Invincibility lies in the defense.”

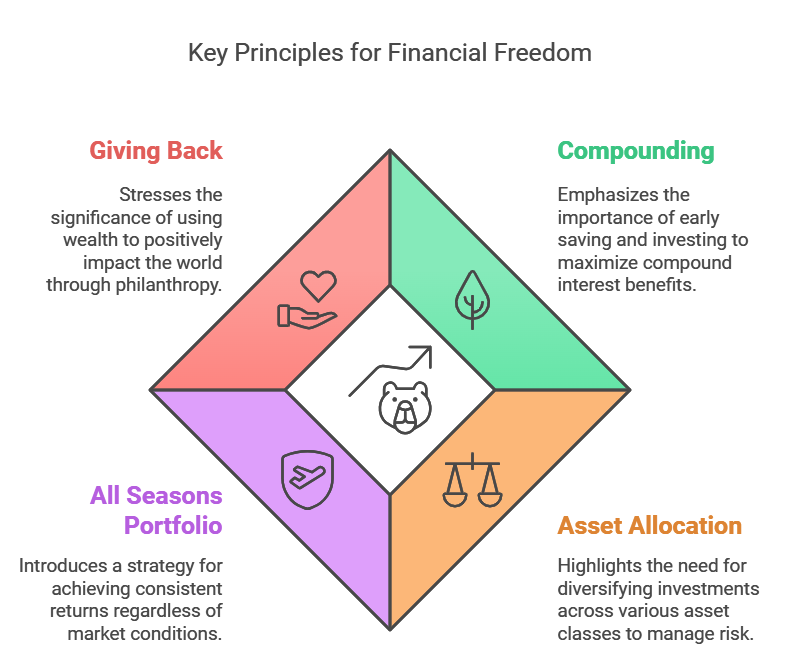

Key Principles and Insights

Throughout the book, Robbins highlights several key principles and insights that are essential for achieving financial freedom:

- The Power of Compounding: Robbins stresses the importance of starting to save and invest early to maximize the benefits of compound interest. He provides examples of individuals who achieved remarkable wealth through consistent, long-term investing.

- The Importance of Asset Allocation: The book explains the concept of asset allocation, which involves diversifying investments across different asset classes, such as stocks, bonds, and real estate. Robbins emphasizes that asset allocation is a key factor in managing risk and achieving long-term returns.

- The All Seasons Portfolio: Robbins introduces Ray Dalio’s “All Seasons Portfolio” as a strategy for achieving consistent returns in any market environment. This portfolio is designed to withstand economic shocks and market fluctuations.

- The Value of Giving: Robbins underscores the importance of giving back and using wealth to make a positive impact on the world. He shares stories of individuals who found fulfillment and meaning through philanthropy.

Debunking Financial Myths

The book dedicates a significant portion to debunking common financial myths that can hinder financial success. These include:

- The Myth of Beating the Market: Robbins presents evidence that actively managed mutual funds rarely outperform the market over the long term. He argues that index funds, which passively track a specific market index, offer a more reliable path to investment growth.

- The Misleading Nature of Mutual Fund Returns: The book explains how the returns reported by mutual funds are often inflated and do not reflect the actual returns earned by investors. This is due to factors such as high fees and the impact of investor behavior.

- The Lack of Fiduciary Duty: Robbins highlights that many financial advisors are not legally obligated to act in their clients’ best interests. He advocates for working with fiduciary advisors who are legally bound to prioritize their clients’ financial well-being.

Beyond Financial Success

While “MONEY Master the Game” is primarily focused on achieving financial freedom, it also emphasizes the importance of finding purpose and meaning in life beyond money.

Robbins argues that true wealth is about fully experiencing life and using one’s resources to make a positive impact on the world. He encourages readers to identify their passions and use their financial success to support causes that align with their values.

“We make a living by what we get. We make a life by what we give.”

Why You Should Read this Book

What’s the Book About?

At its core, “MONEY: Master the Game” focuses on empowering individuals to achieve financial freedom by equipping them with the knowledge, strategies, and tools necessary to make informed financial decisions.

The author emphasizes that financial freedom is attainable for everyone, regardless of their current financial situation, income level, or prior investment experience.

Key Concepts and Principles

Robbins introduces several fundamental principles and concepts related to personal finance and investing, including:

- The Power of Compounding: This principle highlights the exponential growth potential of investments over time. Robbins emphasizes that consistent saving and investing, even with modest amounts, can lead to remarkable results.

- Asset Allocation: This involves strategically distributing investments across different asset classes, like stocks, bonds, and real estate, to manage risk and optimize returns.

- The Importance of Mindset: Robbins stresses that our beliefs about money significantly impact our financial outcomes. He encourages readers to shift from a scarcity mindset to an abundance mindset.

- The Value of Mentorship: The book underscores the importance of learning from successful investors and adopting their proven strategies.

Actionable Strategies

The book is packed with actionable steps and strategies readers can immediately implement:

- Creating a Financial Plan: Robbins provides a detailed framework for setting financial goals, determining the necessary savings rate, and creating a roadmap for achieving financial objectives.

- Automating Savings: He advocates setting up automatic contributions to investment accounts to ensure consistent saving.

- Reducing Fees: Robbins exposes hidden fees associated with various investment products, like mutual funds, and provides strategies for minimizing these expenses.

- Tax Optimization: He offers advice on utilizing tax-advantaged accounts and strategies to reduce tax burdens on investment gains.

Real-Life Examples and Case Studies

To illustrate these concepts, Robbins uses real-life examples and case studies, including:

- Interviews with Financial Masters: The book features interviews with 50 top investors, including Warren Buffet, Ray Dalio, and Carl Icahn, offering valuable insights into their investment philosophies and strategies.

- Anecdotes from Personal Experience: Robbins incorporates personal stories and observations from his extensive experience in coaching individuals to achieve financial success.

Addressing Common Challenges

Robbins acknowledges common financial obstacles and offers solutions for overcoming them:

- Overcoming Limiting Beliefs: He provides strategies for identifying and challenging negative beliefs about money, such as scarcity mindsets or the fear of failure.

- Navigating Market Volatility: Robbins offers guidance on managing risk and making sound investment decisions during periods of market uncertainty.

- Building a Sustainable Income Stream: He discusses strategies for creating a lifetime income plan to ensure financial security throughout retirement.

A 7-Step Methodology

Robbins advocates a clear 7-Step methodology for achieving financial freedom. This framework outlines a sequential process, starting with making the most important financial decision of one’s life (deciding to save and invest), understanding the rules of the game (debunking financial myths), and progressing to building a lifetime income plan and learning from the strategies of billionaire investors.

Self-Evaluation Tools

While the book doesn’t include formal assessments, Robbins encourages readers to:

- Evaluate their current financial situation: He provides prompts for assessing income, expenses, and savings patterns to identify areas for improvement.

- Define their financial dreams and goals: He guides readers to determine their financial aspirations and the steps required to achieve them.

- Track their progress: Robbins encourages consistent monitoring of investments and adjustments to strategies as needed.

Further Reading and Resources

The book offers several follow-up resources:

- “The Automatic Millionaire” by David Bach: This book expands on the concept of finding your “Latte Factor” and automating savings.

- “A Random Walk Down Wall Street” by Burton Malkiel: This classic text provides insights into the workings of the stock market and investing strategies.

- Ray Dalio’s “How the Economic Machine Works—In Thirty Minutes” video: This animated video provides a clear explanation of economic principles.

- “Unconventional Success” by David Swensen: This book outlines Swensen’s approach to asset allocation and investment management, known as the Yale model.

What Makes This Book Unique?

Several factors set “MONEY: Master the Game” apart from other books in the personal finance genre:

- Access to Elite Investors: The book offers unprecedented access to the insights and strategies of some of the world’s most successful investors.

- Focus on Mindset and Psychology: Robbins emphasizes the importance of addressing the psychological and emotional aspects of money management.

- Practical and Actionable Advice: The book goes beyond theoretical concepts and provides concrete steps and tools for immediate implementation.

- Motivational and Inspiring Tone: Robbins’ writing style is engaging, encouraging, and empowering, motivating readers to take control of their financial lives.

“MONEY: Master the Game” is more than just a financial guide; it’s a comprehensive blueprint for achieving financial freedom by combining sound investment strategies with a powerful mindset shift.

Conclusion

“MONEY Master the Game” provides a comprehensive roadmap to achieving financial freedom, drawing on the insights of financial experts and debunking common financial myths. It empowers readers to take control of their finances, make informed investment decisions, and build a secure financial future.

The book goes beyond mere financial success, emphasizing the importance of living with passion, giving back, and creating a meaningful legacy.

Who Should Read This Book

This book offers valuable insights for a wide range of individuals interested in improving their financial literacy and achieving their financial goals. In particular, the following groups would benefit from reading “MONEY: Master the Game”:

- Novice investors who are new to the world of investing and seeking a comprehensive, easy-to-understand guide. Robbins simplifies complex financial concepts and presents them in a clear and actionable manner, making it accessible for beginners.

The book provides a step-by-step roadmap for getting started with investing, building a portfolio, and understanding key principles like asset allocation and diversification.

- Individuals struggling with financial anxiety or feeling overwhelmed by their finances. The book addresses the psychological and emotional aspects of money, offering strategies for overcoming limiting beliefs, managing financial stress, and developing a healthier relationship with money.

Robbins emphasizes that financial freedom is achievable for anyone, regardless of their current situation, and provides motivational support to help readers take control of their financial lives. The book also encourages readers to go beyond just learning about finances and take action to implement the strategies presented.

- Experienced investors who are looking for advanced insights, strategies, and perspectives from some of the most successful investors in the world. The book features interviews with billionaires, Nobel laureates, and financial titans, offering a glimpse into their investment philosophies, portfolios, and decision-making processes.

Readers can gain insights into how these experts approach asset allocation, risk management, and navigating different market conditions. The book also offers strategies for tax optimization and creating lifetime income plans, which are particularly relevant for high-net-worth individuals and sophisticated investors.

- Anyone interested in personal development and achieving a higher quality of life. While primarily focused on finances, the book also explores broader themes of personal growth, mindset, and achieving fulfillment.

Robbins emphasizes the importance of setting goals, taking action, and developing a positive attitude towards challenges. The book encourages readers to identify their dreams and create a plan for achieving them, both financially and in other areas of life.

- Those seeking to make a positive impact on the world through philanthropy. The book highlights the importance of giving back and using wealth to make a difference in the lives of others.

It features stories of individuals who have found fulfillment through philanthropy and encourages readers to consider how they can contribute to causes they care about.

“MONEY: Master the Game” offers a blend of practical financial advice, motivational insights, and inspiring stories that can empower readers to take control of their financial future and live a more fulfilling life.

Enjoyed this Money Master the Game summary? Check out these other book summaries on managing your money here

You may also enjoy:

Leave a Reply to The Power of Compounding: A Tale of Two Brothers – Smart Owl Book Digest Cancel reply